Examples of actual beneficial owners

Go back to page: Who is a beneficial owner?

Example 1

Edmond Example owns 32 percent and Elaine Example owns 25 percent of shares in a limited liability company.

Edmond is a beneficial owner of the limited liability company because he owns more than 25 percent of the company. Elaine is not a beneficial owner because her share does not exceed 25 percent.

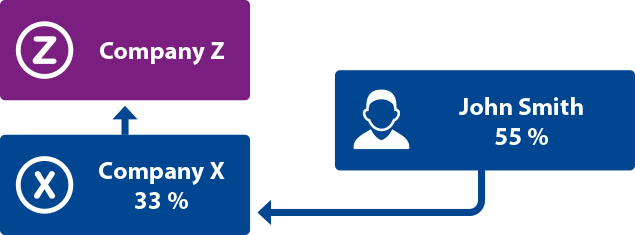

Example 2

John Smith is a majority shareholder with a share of 55 percent of company X, which owns 33 percent of company Z's shares.

John is a beneficial owner of company X because he directly owns more than 25 percent of it. John is also a beneficial owner of company Z. As the majority shareholder of company X, he has a number of votes corresponding to the entire share of company X in company Z. It exceeds 25 percent.

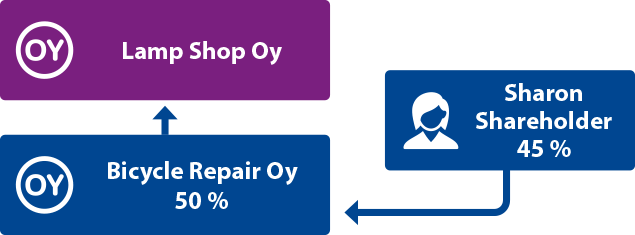

Example 3

Sharon Shareholder owns 45 percent of Bicycle Repair Oy, which owns 50 percent of the shares in Lamp Shop Oy.

Sharon is a beneficial owner of Bicycle Repair Oy, as she owns more than 25 percent of it. However, Sharon is not a beneficial owner of Lamp Shop Oy, as she is not the majority shareholder in Bicycle Repair Oy.

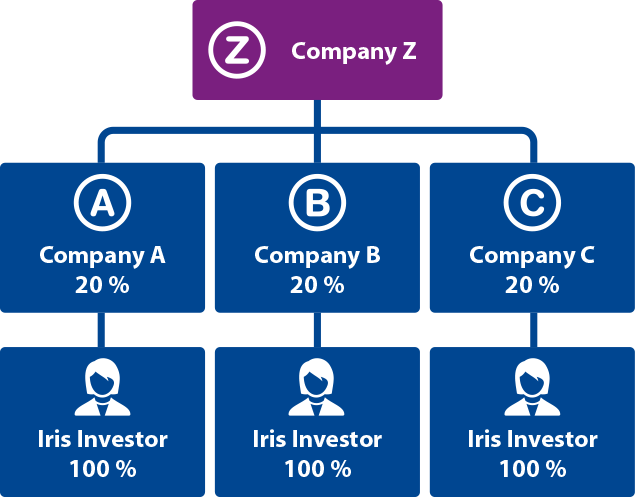

Example 4

Companies A, B and C each own 20 percent of the company Z. Iris Investor owns 100 percent of the shares in companies A, B and C.

Iris is a beneficial owner of companies A, B and C, as she owns more than 25 percent of them directly. Iris is also a beneficial owner of the company Z. As the majority shareholder in companies A, B and C, she exercises independent power of decision so she has a number of votes in company Z which corresponds to her share in companies A, B and C. Iris’ combined share and, at the same time, the number of votes she has in company Z (20% + 20% + 20%), exceeds 25 percent.

Example 5

Four persons each own 25 percent of the shares in a limited liability company. All the shares give equal voting rights. None of the owners exercises control over the company on other grounds.

The company files a notification that it has no beneficial owners.

In accordance with the Finnish Act on Money Laundering, the members of the board of directors and the managing director are considered as beneficial owners in this case. The PRH will make the following entry in the register details of the company:

“The organisation has no actual beneficial owners, or no beneficial owners have been able to be identified. In this case, the board or the general partners of the organisation, or the managing director or any other person in a corresponding position are considered as actual beneficial owners."

Example 6

Four people each own 20 percent and Renovation general partnership owns 20 percent of the shares in Test Oy. Robert Renovator and Rebecca Renovator, part-owners of Test Oy, are both partners in Renovation general partnership.

Robert and Rebecca are beneficial owners of Renovation Ay. However, Renovation general partnership does not file a notification of beneficial owners, as the beneficial owners are persons registered as its partners in the Trade Register.

Robert and Rebecca are filed as beneficial owners of Test Oy. As partners of Renovation general partnership, they exercise independent power of decision in Renovation Ay. For this reason, their number of votes in Test Oy corresponds to their share of Renovation Ay. Both Robert and Rebecca have a direct and indirect share, and at the same time, their number of votes in Test Oy (20% + 20%) exceeds 25 percent.

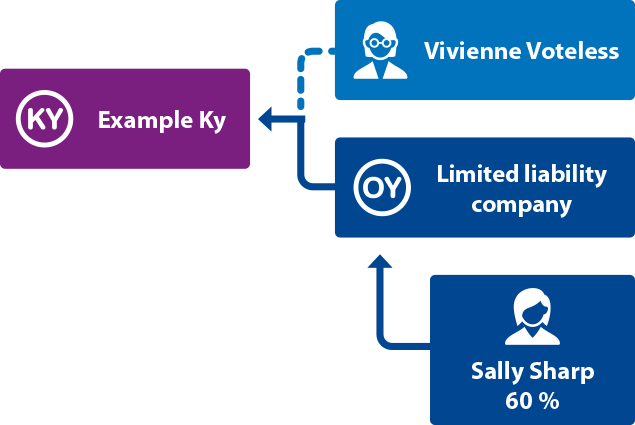

Example 7

The general partner of Example limited partnership is a limited liability company, and Vivienne Voteless is the silent partner. Investor Sally Sharp owns 60 percent of the shares in the limited liability company.

Sally is a beneficial owner of the limited liability company. Sally is also filed as a beneficial owner of Example Ky. Since the general partner of Example Ky is another company, a person exercising independent power of decision in the company serving as the general partner is considered as Example Ky's beneficial owner. Sally is the majority shareholder in the limited liability company with a 60 percent share and thus the person exercising independent power of decision.

Example 8

All Shares Oy has different types of shares. A-shares entitle their holders to a higher number of votes than B-shares. Victor Voter owns 20 percent of the A-shares. The shares entitle its holder to 30 percent of all votes.

Victor is filed as a beneficial owner of All Shares Oy because his number of votes exceeds 25 percent.

Example 9

Share Oy has a total of 200 shares, of which 100 shares are owned by Oliver Owner and 50 shares are owned by Daisy Developer. The remaining 50 shares are owned by the company itself.

When calculating shares of ownership, only the shares not owned by the company itself are taken into account. This means Oliver Owner’s share of ownership in the company is the percentage of 100 shares out of 150 shares, making 66.67 percent. . Daisy Developer’s share of ownership in the company is the percentage of 50 shares out of 150 shares, making 33.33 percent.

Both Oliver and Daisy are beneficial owners of Share Oy as they both have a share of ownership exceeding 25 percent.

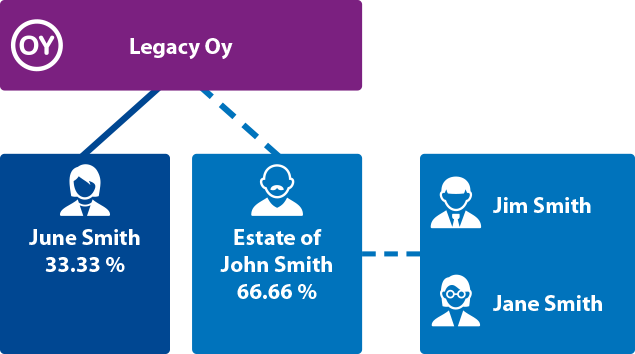

Example 10

Legacy Oy is owned by June Smith and the estate of the deceased owner, John Smith. June owns 33.33 per cent of the company’s shares, and the estate owns 66.66 per cent. There are two parties to the estate: Jim Smith and Jane Smith.

The company files June as its beneficial owner. The estate and its share of ownership are not filed because the estate of a deceased person cannot be filed as a beneficial owner. Similarly, the parties to the estate are not filed as beneficial owners.

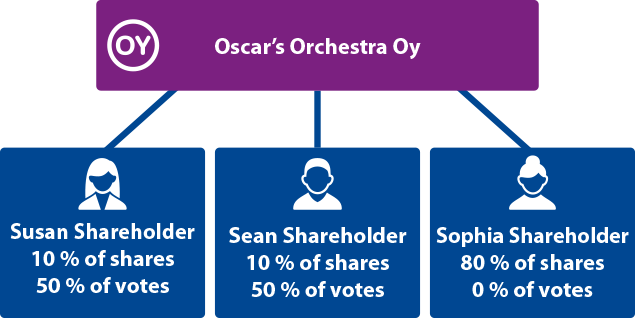

Example 11

Oscar’s Orchestra Oy is owned by three people. Susan Shareholder owns 10 per cent of the company’s shares and holds 50 per cent of the voting rights. The same applies to Sean Shareholder. Sophia Shareholder owns 80 per cent of the shares but has no voting rights.

All three are beneficial owners of the company: Susan and Sean based on their voting rights (the number of votes exceeds 25 per cent for each of them), and Sophia based on her share of ownership (exceeds 25 per cent).

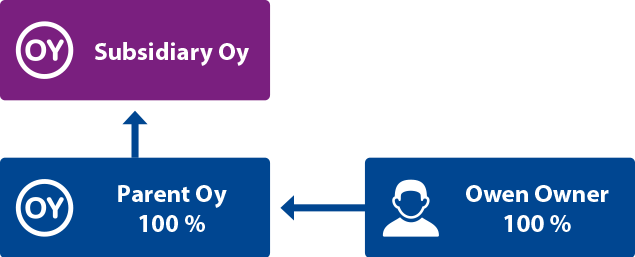

Example 12

Owen Owner is the sole shareholder with a share of 100 per cent of Parent Oy, which owns 100 per cent of the shares in Subsidiary Oy.

Owen is a beneficial owner of Parent Oy because he owns more than 25 per cent of the company directly. Owen is also a beneficial owner of Subsidiary Oy. As the sole shareholder of Parent Oy, Owen’s share of the voting rights in Subsidiary Oy is equivalent to owning all the shares of Parent Oy.

Example 13

In Ownerless Oy, no one owns more than 25 percent of the shares directly or indirectly through another company. Even in other respects, the voting rights have not been centralised to anyone, for example on the grounds of a partnership agreement.

The company files it has no beneficial owners.

In accordance with the Act on Money Laundering, the members of the board of directors and the managing director are then considered as the beneficial owners. In this case, the PRH will make the following entry in the register details of the company:

“The organisation has no actual beneficial owners, or no beneficial owners have been able to be identified. In this case, the board or the general partners of the organisation, or the managing director or any other person in a corresponding position are considered as actual beneficial owners."